After money are deposited to your PayPal account, you will receive an email notification. Check your email for a communication from the online service if you are awaiting payment. The email will state how much money you got and who gave it to you.

How to Check if You Got Paid in PayPal

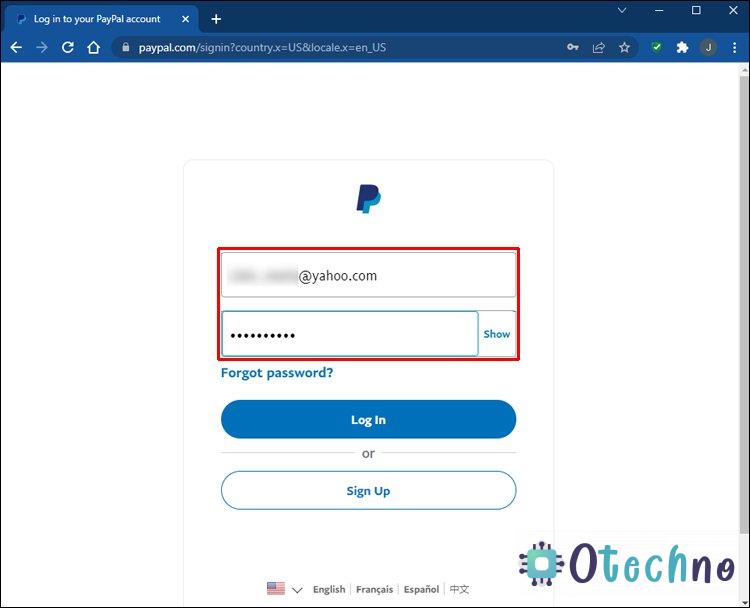

1. Open PayPal website an login with your information.

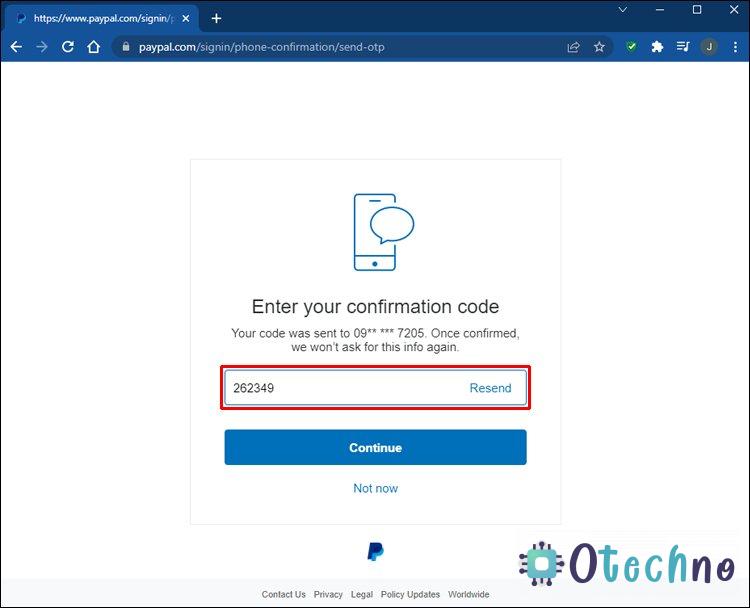

2. If you have activated two-factor authentication, get the code from your phone.

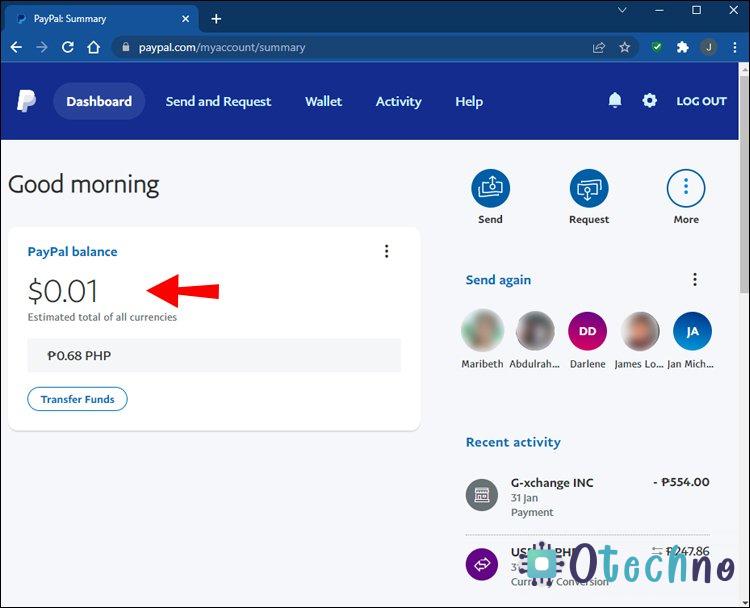

3. Once you have logged in , your account balance will be displayed at the top left .

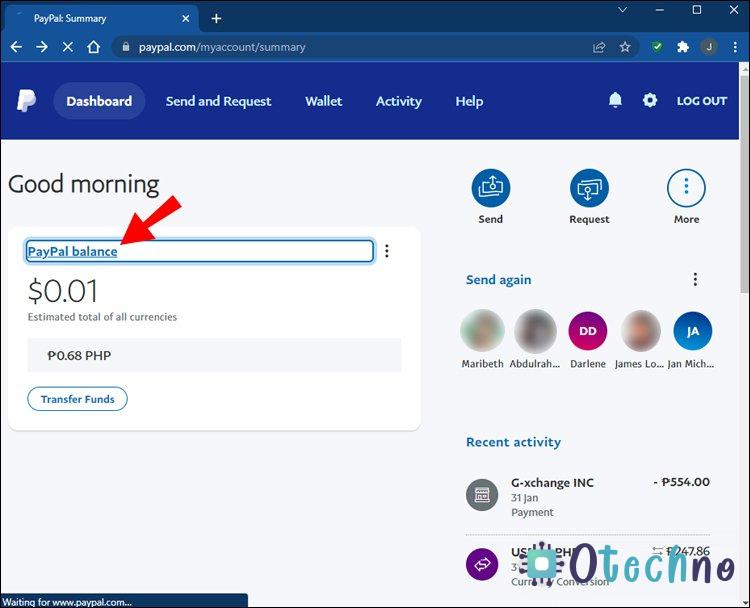

4. Click on “PayPal balance” to get more information on your account balance.

What is Paypal

PayPal is a digital payment platform that allows users to make transactions online without the need for physical currency. It was founded in December 1998 under the name Confinity, which later merged with X.com in 2000, before being renamed PayPal in 2001. Since then, it has become one of the most popular payment methods used worldwide, with over 300 million active accounts in more than 200 markets.

PayPal enables users to create an account for free and link their credit or debit cards, as well as bank accounts. Users can then use the platform to send or receive money, make purchases online or in-person, and manage their financial transactions. PayPal also offers other services, such as the ability to accept payments through websites and mobile applications, and the option to send invoices to customers.

How PayPal Became One of the Most Popular Payment Methods Worldwide

One of the primary advantages of using PayPal is its ease of use. Once a user has set up their account and linked their payment information, they can make transactions with just a few clicks. The platform also offers strong security features, including fraud protection and encryption, to ensure that users’ financial information remains safe.

In addition, PayPal is widely accepted by online retailers and businesses, making it a convenient payment option for consumers. Many e-commerce platforms, such as eBay, Amazon, and Etsy, offer PayPal as a payment method, and the platform has become a popular choice for freelancers and small businesses looking to accept payments online.

Another benefit of using PayPal is its international reach. The platform supports transactions in more than 100 currencies, and users can send money to and receive money from other countries. This makes it an ideal option for businesses and individuals that operate globally.

However, there are some downsides to using PayPal as well. One of the biggest criticisms of the platform is its fees, which can be higher than other payment options, particularly for international transactions. PayPal charges a percentage of the total transaction amount, as well as a fixed fee per transaction, which can add up over time.

Additionally, PayPal’s policies can be strict, and the platform has been known to freeze accounts or restrict access to funds in some cases. While this is typically done to prevent fraud or other illegal activities, it can be frustrating for users who are unable to access their money when they need it.

Despite these drawbacks, PayPal remains a popular choice for many people around the world. Its ease of use, security features, and international reach make it a convenient option for online transactions, and its widespread acceptance by businesses and retailers makes it an important part of the digital economy. As online commerce continues to grow, it seems likely that PayPal will continue to play a key role in facilitating financial transactions in the years to come.